Ever since the issue of HDB ownership was brought into the spotlight, many owners of HDB flats are concerned about the depreciating values of their flats. Moreover, many young couples have started to see HDB flats as a depreciating asset and have started to shun them altogether. Some young couples have made their first property purchase a private property. Most often I get buyers shunning older flats for fear of their depreciating value. The concern I have about this is that buyers are making a property purchasing decision based on whether they can potentially make or lose money from the property rather than whether the property has attributes that suit them. My mantra is always that a home is a home first and an investment second. If you purchase a home because of its good facing, good layout. good location, easy connectivity to transportation services, close proximity to amenities and good schools, then you can be certain that the next buyer will be attracted to the same attributes to the property as well.

Now the question most buyers pose to me in my field of work is, “Can an HDB flat be a good investment?”

This then goes back to what you define as a good investment. On one camp, a good investment is something that can be bought for a certain price and sold off at a later date for a higher price. Impressive as it may seem, capital appreciation is merely one aspect of property investment. The other aspect is rental yield.

Let us first understand rental yield.

For real estate, rental yield is the annual rental income as a percentage of the property’s purchase price. Thus if you bought a 1-bedroom condominium for $700,000 and you collect $2,000 a month from renting it out, your rental yield is

($2,000 x 12 months) / $700,000 x 100% = 3.43%

What this means is that every year you will get back 3.43% of the property purchase price in the form of the rent that you collect. To collect the full 100% of your property price, you would have to rent the property out at that price for 100/3.43=29.15 years. This is assuming that the property is always occupied and this calculation does not take into account any expenses you may incur as a homeowner and landlord. As this does not take into account expenses, this is considered gross rental yield.

I have a video to explain this:

Now let us extract some data from HDB’s website at www.hdb.gov.sg.

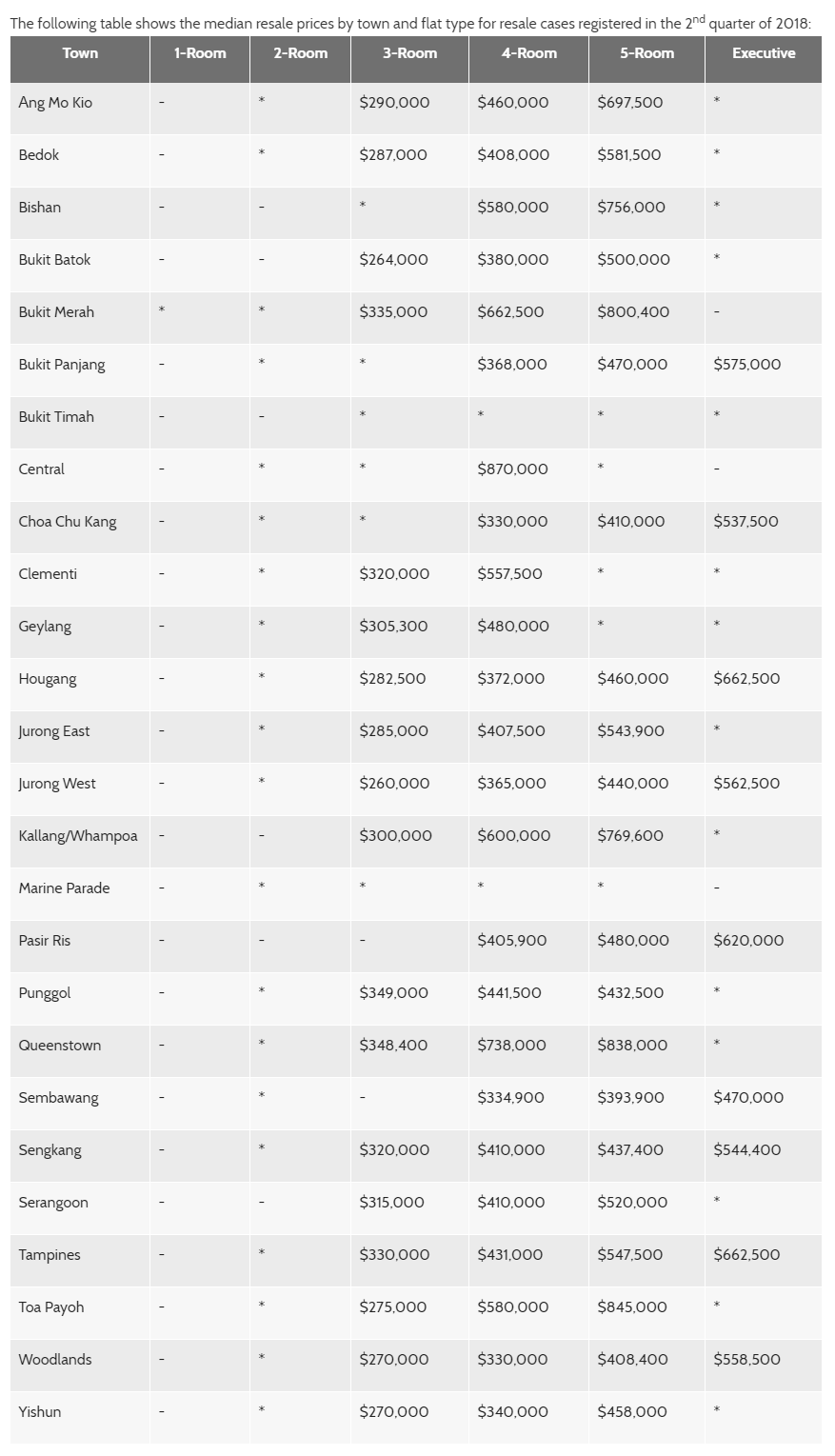

This is the median resale prices listed out in town and flat types for the 2nd quarter of 2018

Median HDB Resale Prices for 2nd quarter 2018

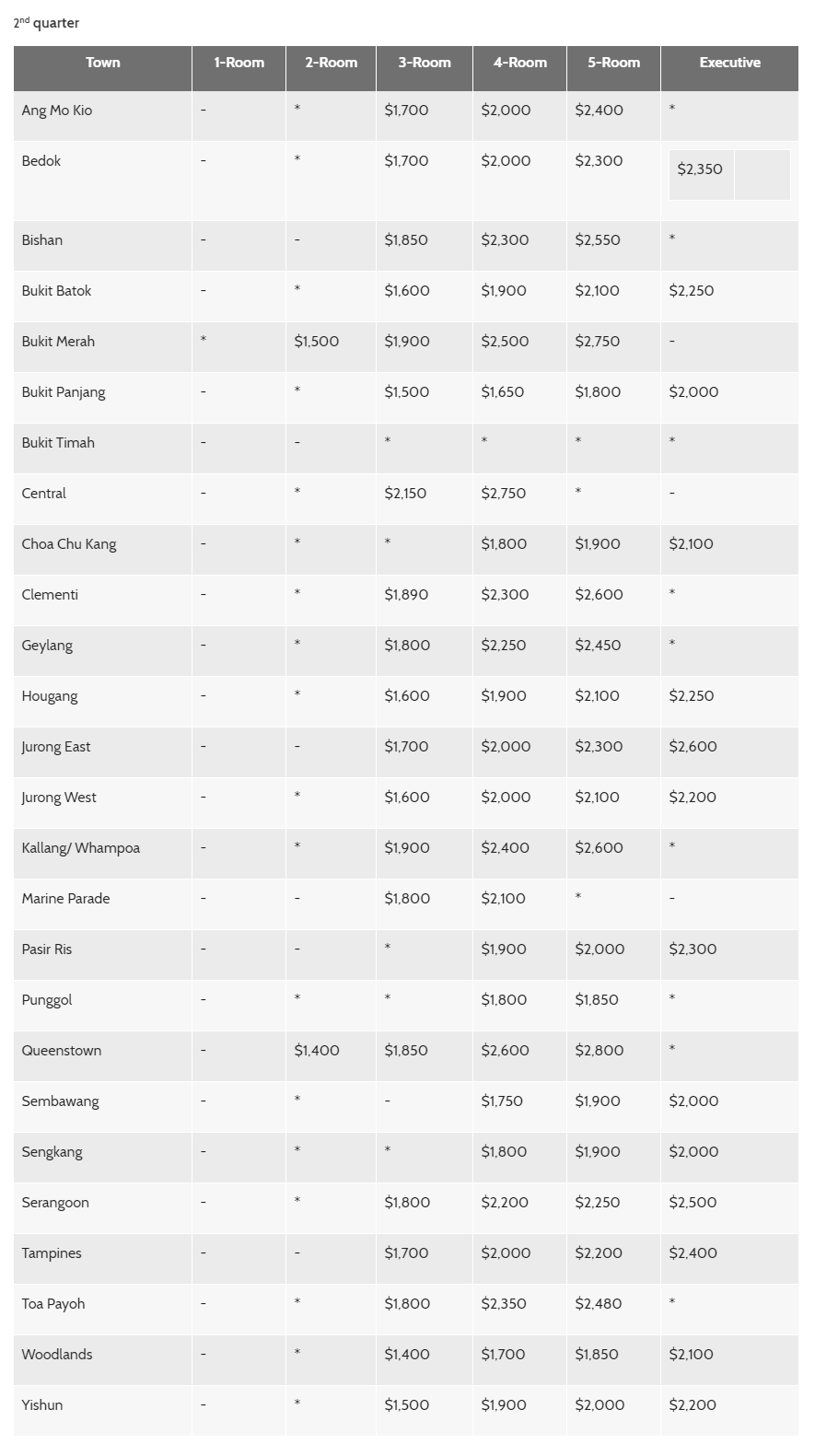

This is the median rental prices listed out in town and flat types for the 2nd quarter of 2018

Median HDB Rental Prices for 2nd quarter 2018

For columns with an *, it indicates that there are less than 20 transactions for that particular segment. Without a large enough sample size, we should not use the data as it may be skewed.

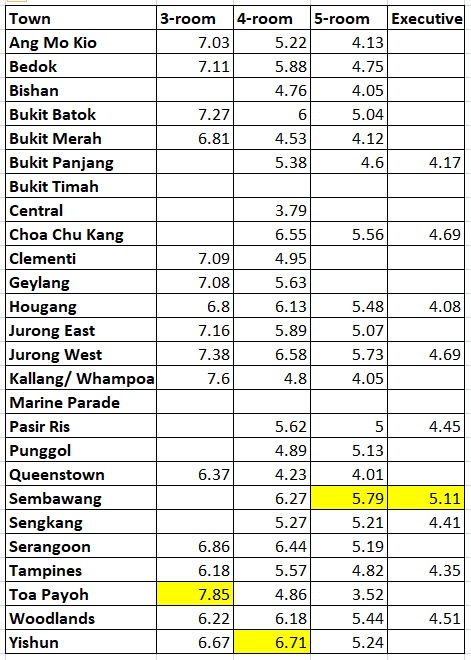

Now let us calculate the gross rental yield of the relevant towns by room types.

Gross Rental Yield for HDB Flats by town and room type for 2nd quarter 2018

As you can see, HDB flats give an extremely high rental yield. The highest being 3 room flats in Toa Payoh with a gross rental yield of 7.85%. While some may be concerned about the depreciating values of HDB flats (I never said that this was not important. I am just highlighting another side of HDB flats as investments.), some HDB owners are collecting a 7.85% yield on their HDB flat in Toa Payoh. I would assume that this figure could potentially be higher if this HDB flat owner bought his 3 room flat much earlier at a cheaper price.

HDB flats were built with the initial intent to house the masses. Over time, people saw it as a form of investment that could be bought and sold for a higher price at a later date. Slowly,

So now what advice would I give to Singaporeans wanting to build their property investment portfolio. This especially applies to young couples just starting out and hoping to get into the property market.

1) Start with a 3-room flat in the resale market

Going by statistics, a 3-room flat is the best rental yield you can get in the HDB market. The main reason why I would advocate the resale market is because you do not have to ballot and wait for your flat to be built. If you would like to start your property investment journey earlier, going the Build-To-Order (BTO) route may not be the best option. I have seen couples deciding to settle down in their early 30s, ballot countless times for a flat in their ideal location and then having to wait a couple of years before getting the keys. By the time they complete their Minimum Occupation Period (MOP), they are already in their 40s.

With the lower quantum and the first-timer grant, you could most probably finish paying off your 3-room HDB flat earlier than if you bought a larger flat. Once you do not have an outstanding loan on your HDB flat, you are then eligible to take a full loan on your next property purchase (i.e. Loan-To-Value of 75%).

2) Utilise the grants to lower the purchase price

Well, it won’t actually show that the purchase price is lower but there are grants accorded to first-time HDB buyers. First time home buyers can get up to $50,000 based on the type of flat that they purchased. The grant for a resale 3-room flat for a first time is $50,000. In fact, the grant for larger flats is lesser than the grant for smaller ones. Also, if couples stay close to their parents, they can enjoy a grant of $20,000. If their parents live with them then they can obtain $30,000. Imagine offsetting the price of a resale 3-room HDB flat with these grants. Your acquisition cost could be rather low. If you factor in the actual price you pay for the flat after the grants, then the rental yield will turn out even higher.

For example, a Clementi flat’s median price is $320,000 and has a median rent of $1,890.

Rental yield = ($1,890 x 12) / $320,000 x 100% = 7.09%

If you factor in a first timer grant of $50,000 and a near parents grant of $20,000, your actual purchase price is $320,000 – $50,000 – $20,000 = $250,000

Rental yield = ($1,890 x 12) / $250,000 x 100% = 9.07%

3) Go for a smaller flat in a better location

Remember, this property is going to be your investment property. You want to be able to rent it out as quickly as possible when you move on to another property in the future. The statistics tell you the median rental prices. They do not tell you how long it took for those flats to get rented out. Certain flats may take significantly longer than others to get rented out. The main reason is usually the location. The common error most buyers make is that they associate what is comfortable with them with what tenants may think. I have had clients who have lived in the outer regions of Singapore telling me that they think rental demand is going to be strong because they find it convenient. The main reason why they found it convenient is that they have lived in that location for the most part of their life.

4) You may not need the extra room or space of a bigger flat

Many do shun smaller flats because they want to have 3 bedrooms. More often than not there may be a periodic need for an additional room. Maybe a guest room for the rare occasions that someone comes and visit. However, to fork out an additional $100,000 or more just to buy a bigger flat for these rare occasions does not seem very prudent. Some couples do want to start with a 4 or 5-room flat with 3 bedrooms because they would want an additional bedroom for when children arrive. However, in most cases and speaking from personal experience, your child will stay with you and your spouse in your bedroom for the first couple of years. If you add up the time it takes to get pregnant and give birth as well as the time the child grows up and musters enough courage to want to sleep in his or her own room, that period should be longer than the 5-year MOP.

Yes, it may feel a little cramped in a 3-room flat. However, in most cases, it is really enough for one or two people and if your property is very centrally located, you may be spending a great deal of time at the nearby mall or other amenities.

5) Aim to pay off your mortgage on your flat as quickly as possible

This is probably easier if you had bought a cheaper flat in the first place. A 75 per cent loan on that 3-room flat in Clementi in our example that costs $320,000 would be $240,000 with a monthly mortgage of $1,088. After 5-years on an HDB loan of 25 years with an interest rate of 2.6 per cent, you would be left with about $209,000 of the mortgage. This is not a small sum but a 25 per cent down payment on a $1,000,000 condominium will cost $250,000. If you could afford a 25 per cent downpayment on that condominium, you could alternatively use the money to pay off your outstanding mortgage on your HDB flat. Assuming your household income is strong enough to purchase a condominium, when I mean strong enough I am assuming a joint income of about $15,000 a month or at least $200,000 per annum including bonuses, then saving up for that downpayment may not take too long if you are relatively debt-free and thrifty.

There is an inherent advantage of having a spare property. In this case, a spare 3-room HDB flat that is fully paid for. In many instances, sellers may sell their property when the property market is high only to purchase a replacement property at similar peak market conditions. If you do not need to sell to make the next purchase, you can purchase a property at the opportune moment when the property market is bearish. If you are able to be a true contrarian and look at the property market when demand is exceptionally weak, then you may be able to pick up some decent deals. This is especially true in the resale market.

So imagine that you have paid off the 3 room flat at Clementi and now you would like to purchase a condominium for $1,000,000

Purchase price: $1,000,000

Down payment: $250,000

Stamp Duty: $24,600

Additional Buyers Stamp Duty: $120,000

You will need a total of $394,600 in cash and CPF for the down payment and stamp duties.

You will have a mortgage repayment of $3,364 based on a Loan-To-Value (LTV) of 75 per cent, loan tenure of 25 years and an interest rate of 2.5 per cent.

You will still be collecting your rent of $1,890 from your 3-room HDB flat and technically if you used your rental income to offset your mortgage, your monthly instalment is reduced to $1,474.

This is still assuming that the household income is at $200,000 per annum. There is no loss of income or salary increment.

I am assuming that this would be a very comfortable situation for most people.

I am personally someone who likes to collect monies over an extended period of time. Of course, it would be really satisfying to make large capital gains but then I really do think that such times are probably over. I touched on the factors why I think property prices may be high. You may want to refer to my previous article.

Are Singapore property prices too high?

Next, let us compare the actual cost of owning an HDB flat and renting it out versus owning a condominium and renting it out.

1) The holding and maintenance costs of HDB flats are low compared to condominiums

You will need to pay the conservancy fees to the town council and if you own a 3-room flat, these fees are very low. In comparison, if you own a 1-bedroom condominium unit, your maintenance fees are most probably going to cost around $250 a month or more. If you factor in these expenses, the difference in net rental yield will diverge even further.

2) HDB flats are generally well maintained

There are many instances whereby condominiums are not properly maintained and look rather old and shabbily maintained, especially if a large number of condominium units are rented out. On the other hand, HDB flats are maintained by the various town councils. Their upkeep even after 40 to 50 years is commendable and there are periodically upgraded and repainted to rejuvenate the neighbourhood. I do not think that the living environment of flats in Clementi central will be very much poorer 10 or 20 years down the road. In fact, I expect the living environment to remain constant or improve. I cannot say the same about private condominiums if they are not managed properly.

There are of course a few things to take note of.

1) You will have to incur Additional Buyer’s Stamp Duty (ABSD) on your second property purchase.

If you are purchasing a second property for $1,000,000, the ABSD on the property is 12% or $120,000. This is a hefty sum but if you consider the grants you received as an HDB first timer as well as the exceptionally high rental yield you would be getting if you rent out your HDB flat, then it would mitigate the pain of paying the ABSD.

2) This planned scenario is for those who would like a stable source of income.

There are many different types of people in the market. There is no best property investment strategy. Not everyone can stomach the additional risk and instalment of having multiple properties. Not everyone is comfortable with selling off their HDB and buying two condominiums, one in each spouses name. There are some who think that they should straight away start off with a condominium rather than an HDB flat while there are others who want to buy BTO and do not mind the wait just so that they can profit from the spike in price once the BTO flats clear their MOP and are eligible to be sold.

I personally think that the profits to be made in the resale market is going to be much smaller than in the past few decades. If we think of buying properties to have them rented out, location is truly key. If you were to purchase a condominium right next to the MRT station, it would cost a lot more than an HDB flat in that same location. Granted that the HDB flats cannot be rented out at the same rate as a similarly located condominium but the percentage difference in rent will not be as large a percentage difference as the price between a condominium and an HDB. When in doubt, please look for financial advice from your financial advisor and an experienced property agent.

So to me, I really do not think of my HDB as a depreciating asset. I view it as an asset that will provide me with a good rental income. I treat it like an annuity which I can start withdrawing from at a much younger age. Hey but that is just my opinion. As I mentioned, everyone has different investment perspectives.

Yours Sincerely,