Dear family and friends,

This article was contributed by Elwyn Chan, the CEO of Stirling Fort Capital. (an independent multi-asset fund management company regulated by the MAS)

China markets look vulnerable with Shanghai Composite index retracing more than 5% from its April high. China has embarked on a tightening bias by draining liquidity from the banking system. Stricter regulatory oversight also seems to be the order of the day with the newly appointed Chairman of China Bank Regulatory Commission (CBRC), Mr Guo Shuqing, taking additional steps to crackdown on the popular wealth management products. An indication of liquidity stress is shown in a key Chinese money-market rate, 3-month Shanghai Interbank Offer Rate (SHIBOR), which has climbed to 4.35%, near its two-year high.

We share key thoughts on the tightening Chinese liquidity scenario:

- Regulatory crackdown

- Reflation pause

- Tightening of liquidity

- Regulatory crackdown

A new banking regulatory framework, Macro Prudential Assessment (MPA), is formally implemented in 1Q 2017 to replace the previous framework that split the responsibilities among regulators of banks, the stock market and insurers. The MPA is focused on systemic financial risk beyond loans. It takes into account “broad credit growth” and this include on/off-balance sheet items such as interbank assets, receivables and wealth management products (WMPs). This is similar to an aggregate financing concept instead of just looking at merely the loan books.

This comes on the back of the appointment of Mr Guo Shuqing as the Chairman of CBRC who is keen to increase regulatory oversight. It is reported that CBRC has asked lenders to report the size of their entrusted investments, including products issued by mutual funds, trusts, futures firms and brokerages by 12 June.

Since 2014, the shadow banking system has used entrusted investments such as WMPs to leverage up and invest in various asset markets such as stock market and property market. This has resulted in a leveraged carry trade and asset prices to be inflated. It is estimated that the value of banks’ outstanding WMPs is at RMB$29.1 tn at the end of March, equivalent to 12.5% of total domestic bank assets (according to CBRC). Therefore, if the leveraged carry trade of entrusted investments is to unwind, a sizeable amount of liquidity may be withdrawn from the system and caused asset prices to correct.

- Reflation pause

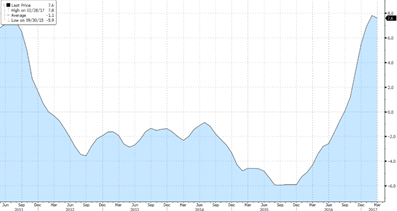

Commodity prices have played an important role in triggering reflation in Asia via the form of producer inflation (PPI). However, the recent reflation trade is unwinding with a retracement of more than 6% in the Thomson Reuters CRB Commodity Index from its April high. PPI inflation in China has also moderated to 7.6% y-o-y in Mar 17 after peaking at 7.8% y-o-y in the previous month. This comes on top of the recent weakness in Chinese manufacturing PMI which declined to 51.2 from a peak of 51.8 in the previous month. It missed consensus estimates of 51.7.

The equities market has enjoyed a strong rally in the past year as a result of the reflation trade narrative. A large part of the reflation trade comes from China with Chinese PPI rising from -0.8% in August 2016 to a high of 7.8% in February 2017. If commodity price continues to soften as a result of weaker economic activity, the reflation trade narrative may lose its momentum. Therefore, investors need to keep a watchful eye on this before adding on to more risk positions.

Chart of China PPI

Source: Bloomberg

- Tightening of liquidity

Liquidity is tightening in China with a widely watched indicator, the 3-month Shanghai Interbank Offer Rate (SHIBOR), having climbed to 4.35%, near its two-year high. This has come on top of the Chinese authorities to raise wholesale funding cost and drain liquidity out of the shadow banking activities. The short-term implication is this could result in a sharp deceleration of shadow banking and trigger rising default risk of leveraged companies.

Shanghai Composite Index has also retraced more than 5% from its April high. If it decisively breaks past its support of 3100, a risk-off in the equity market may ensue. Then, investors may be better to sell in May and return to markets when the risk-reward is more favourable. Ahead of the 19th Party Congress in November, where China’s top leadership prize highly prize stability, we believe any sharp market correction could be ultimately back-stopped, presenting fresh buying market opportunity.

Chart of Shanghai Composite Index

Source: Bloomberg