We all have our favourite colours. But some colours symbolise different meanings in China and US. For instance, Red symbolises prosperity in China in contrast to the meaning of danger in US.

Colours also have different associations for the financial markets. In China, Red signifies a rising market while Green denotes a falling market. This is the opposite in the US where Red points to a sliding market and Green indicates an ascending market. In the currency world, the US dollar is typically termed as the “Greenback” while the Chinese Yuan is increasingly being referred to as the “Redback” – no doubt an attempt by traders to bestow a catchy phrase to the red-based background of the Chinese Yuan.

Against the backdrop of the above colourful anecdotes, we share 3 thoughts of the “Redback” which has played an increasingly important role in the financial markets:

- 811 and 911

- The “Redback” moves into centre stage

- Impact of falling Chinese imports

- 811 and 911

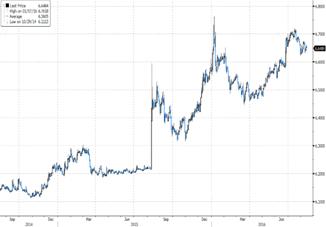

911 is an important number in US. It refers to the date of 9 September 2011 where US was hit by terrorist attacks. In China, it has 811 – the date of 11 August 2015 where the Chinese Yuan was devalued and moved to a managed float against a basket of major currencies. Since then, the Chinese Yuan has depreciated 6.4% against the US Dollar, and is currently hovering near the 5-year bottom of 6.7618 (set at 6.7618 on 7 Jan 2016).

Despite this, the market is calm and has not sparked wider concerns unlike the volatile movements early this year. Shanghai Composite Index has, however, performed better and has rallied more than 18% to 3125.

2-year chart of Chinese Yuan

Source: Bloomberg

2. The “Redback” moves into centre stage

The movement of the Chinese Yuan will likely be dictated by the upcoming events of G20 meeting and the inclusion ofChinese Yuan into the IMF’s Special Drawing Rights (SDR) currency basket.

The G20 heads of governments will convene for a meeting in Hangzhou, China. The Chinese Yuan typically display signs of short-covering with slower depreciation ahead of G20 meetings. We have seen such precedence in the recent G20 finance ministers and central bank governors meetings on 26-27 February 2016 in Shanghai and on 23-24 July 2016 in Chengdu.

In addition, the Chinese Yuan is slated to join in the SDR on 1 October 2016 with a significant 11% weighting in thecurrency basket. The World Bank is supporting this development with the potential issuance of SDR bonds in China. These bonds, backed by the SDR currency basket, will be denominated in Chinese Yuan and sold in the Chinese domestic market.

- Impact of falling Chinese imports

The Chinese Yuan devaluation has significant impact on Asia exporting countries such as Singapore, Malaysia and South Korea which have witnessed double-digit drops in their exports to China this year. Chinese’s purchasing power has been reduced, resulting in slowing demand for foreign goods. Imports have borne the brunt of this impact, with imports tumbling 12.5% in July. This is on the back of an 8.4% contraction in the previous month.

Yesterday, the Shenzhen Stock Connect was approved where international investors will be allowed to invest in companies listed in Shenzhen. This is an extension of the Shanghai Connect which allowed two-way investment flows between Shanghai and Hong Kong stock market. Chinese stocks have rallied in recent days in anticipation of this announcement with the Shenzhen Index rallying more than 4% in 3 days. So, there could be a “sell on news” with profit-taking by investors.

Therefore, the next two months will likely be volatile after a period of relative calm in the markets. Macro movements surrounding the Chinese Yuan “Redback” will also play a vital role in determining whether markets remain positively red (as favored by the Chinese) or bloody red (as feared by the Americans).

Best regards

Elwyn Chan, CAIA

————————————–

CEO, Stirling Fort Capital Pte Ltd

391A Orchard Road #08-07 Ngee Ann City Tower A S238873

(A Registered Fund Management Company with MAS)

– Director, Stirling Fort ASEAN Real Estate Fund I SPC

– Director, Catalyst Stirling Fort Pharma Fund SPC