Recently there has been a huge surge of euphoria in the Singapore property market. In the first quarter of 2018, home prices rose by 3.1%. En bloc sales fever is sweeping the country as developers cash in on older developments to stock up their land banks. Projects like the 99-year leasehold development, Park Place Residences, next to Paya Lebar MRT have good take-up rates even when the average prices are about SGD$2,000 per square foot. Many Singaporeans want to get into the private property market before prices rise and inadvertently when property investment is mentioned, Singaporeans will focus on buying condominiums.

However, I personally think that as a Singaporean, the ultimate goal in property ownership is to own a landed property. Landed properties, with the exception of those at Sentosa Cove, can only be bought by Singaporeans. There are instances whereby permanent residents have successfully applied to the Singapore Land Authority (SLA) for permission to purchase landed properties but these are usually exceptions rather than the norm. In most cases, such applications rarely get approved and even if they do get approved, there are many caveats attached to the approval. So in a nutshell, only Singapore citizens can own landed properties.

Let us consider the following points when deciding whether to buy a landed property or a condominium.

1) The monthly outlay on a landed property is not much more than a condominium

I am taking the assumption of a household that requires 4 bedrooms. A 2-storey freehold landed property with three rooms on the 2nd level and one on the first would cost in the region of about SGD$2.4 million whereas a 4 bedroom freehold condominium should cost about SGD$1.8 million. Let us now calculate how much different the finances of these two properties would work out to be.

Purchase an SGD$2,400,000 landed property

20% downpayment: $480,000

Stamp Duty: $80,600

80% loan: $1,920,000

Monthly instalment for 30 years at 1.8% interest: $6,906.21

Purchase an SGD$1,800,000 condominium

20% downpayment: $360,000

Stamp Duty: $57,500

80% loan: $1,440,000

Monthly instalment for 30 years at 1.8% interest: $5,179.66

Monthly maintenance fees: $500

Total monthly outlay: Approximately $5,700

The monthly outlay for a 2-storey, 4-bedroom landed property is about 20% more than a 4-bedroom condominium.

20% may seem substantial to some but my next few points may put paid to that thought.

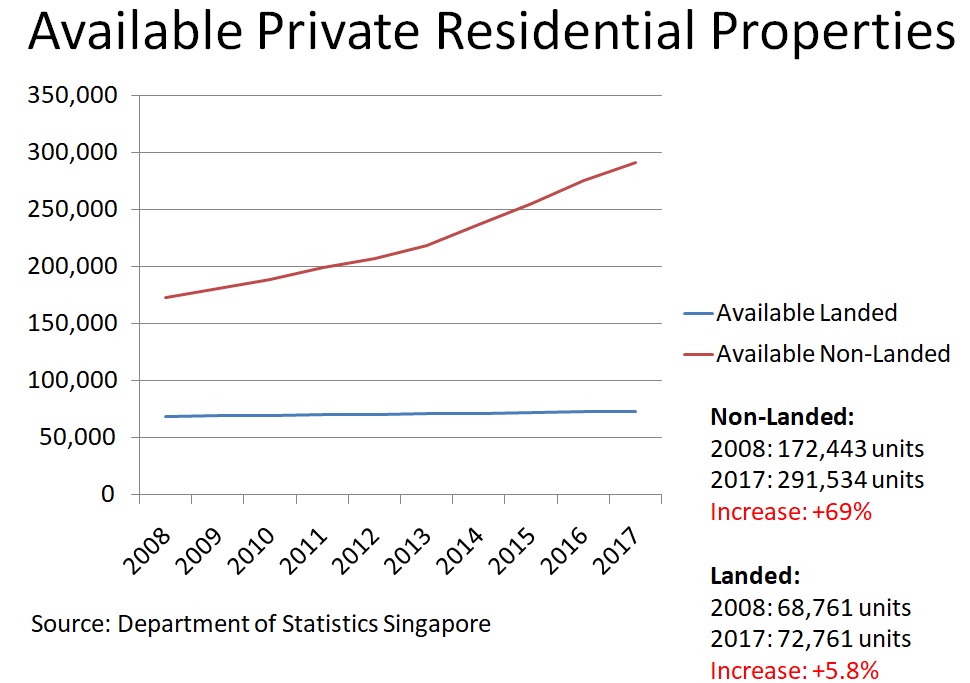

2) The supply of landed properties is very low compared to the supply of condominiums

In 2008, there were 172,443 non-landed properties and in 2017, there were 291,534 non-landed properties. In contrast in 2008, there were 68,761 landed properties and in 2017, there were 72,761 landed properties. In the space of 10 years, the number of landed properties increased by a mere 5.8% whereas the number of non-landed properties increased by 69%. The only way there can be an addition of any landed property to the market is if there is a subdivision of land or the government releases new land for landed properties. The government can only release 99-year leasehold land and thus freehold landed property land is extremely scarce and valuable. Also, not every plot of land can be subdivided. There are strict criteria for the subdivision of landed and over time as larger plots are broken down into smaller plots, we will reach a point whereby an increasingly limited number of landed units can be formed through this method.

On the flip side, many more condominium units will be released into the market. The government has available land which it will release into the market for developers will bid for. Developers are also aggressively purchasing land to build condominiums through en bloc sales.

In the space of 10 years, the increase in non-landed properties is about 12 times the increase in the number of landed properties. This gap is going to grow even wider in this current property upcycle. Developers are stocking up their land bank and there is going to be a large number of condominium units coming into the market in the very near future. In stark contrast, there are no significant landed developments coming into the market. In fact, according to the Urban Redevelopment Authority (URA), for the period of 2018 to 2022, there will be 795 landed units released whereas there will be 23,768 non-landed units coming onto the market.

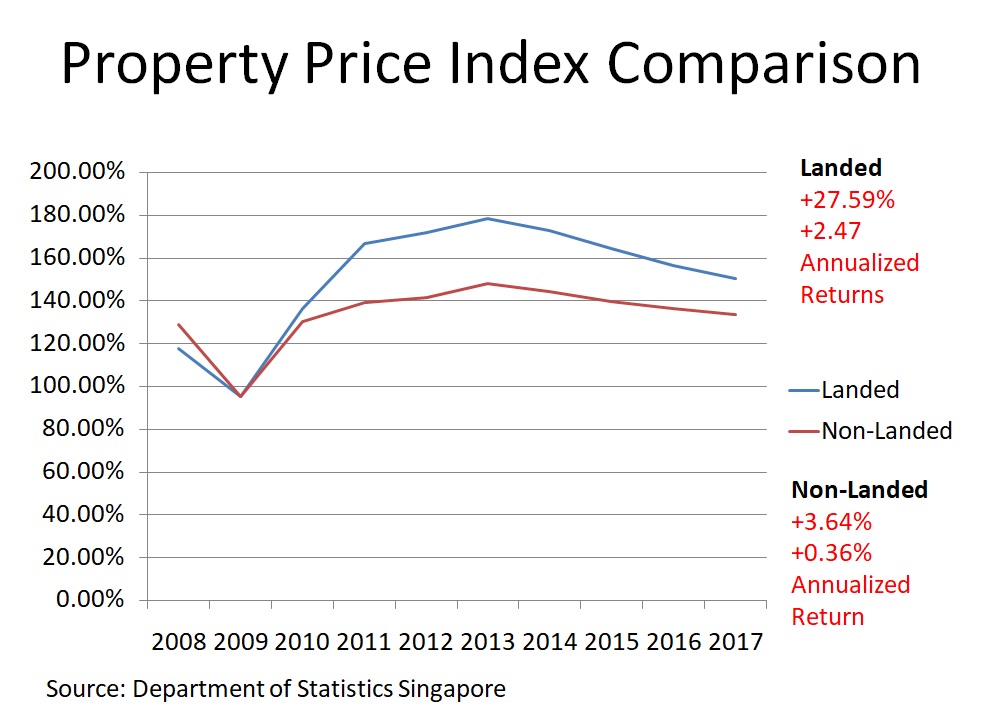

3) Landed prices have increased more than non-landed prices

For the period of between 2008 to 2017, landed properties had an annualised return of about 2.5% whereas non-landed properties had an annualised return of about 0.4%. Landed properties hold and increase in value over time. More so than non-landed properties. In the coming years, as Singapore’s population increases, there will be a stark shortage of landed properties. There will be limited supply of landed properties as compared to condominiums.

4) Singaporeans are going to be more wealthy

This according to Credit Suisse Research Institute’s 2017 Global Wealth Report. In 2017, the number of millionaires in Singapore rose 2.7 percent to 152,000. By 2022, this number is expected to reach 170,000. As the population becomes more wealthy, we should see a gradual increase in the demand for condominiums and landed properties. Since land is extremely scarce in a place like Singapore, the bulk of the land would be used for high rise developments. This leaves us in a situation whereby landed properties are going to be extremely scarce and yet the demand for them should increase. This should mean that prices will increase and it should increase at a faster rate than condominiums.

5) Landed properties are currently still better value for money

They are better value for money in terms of built-up space. A freehold 2-storey inter terrace sitting on a land size of approximately 1,800 square feet would have a built-up area of approximately 2,200 square feet. Such a property in Hougang or Serangoon could be bought for in the region of about SGD$2.2 million. This works out to about 1,000 per square foot. In contrast, the prices of condominiums in the same area should have prices in excess of SGD$1,300 per square foot. 99-year leasehold projects like Park Place Residences in Paya Lebar are already being sold for prices of about SGD$2,000 per square feet. In some cases, some of that paid space includes aircon ledges and balconies. If you are Singaporean and are looking for a large property, you should consider purchasing a landed property.

It has been approximately a decade and a half since I entered the real estate industry. In that period of time, I have seen the price increases which accompanied the condominium and landed property markets. The price gap should get gradually wider as time goes by. In the past, condominiums were more appealing as there was an added security and facilities. However, nowadays this appeal is diminishing as Singapore is relatively safe whether one lives in an HDB flat, a condominium or a landed property. Also, not everyone will use all the facilities in a condominium and if you do not use the facilities, the maintenance fees still have to be paid. In my opinion, if you have the added budget and want a property with true potential upside, look to buy a landed property.

Yours Sincerely,

Other relevant articles:

Factors that determine the price of a landed property in Singapore

Guide to landed property in Singapore

Why you should upgrade to a private property

Buying a Landed Property and Rebuilding it. A Personal Experience.

If you are interested in landed properties, you may be keen to attend this landed workshop.